25

1720

114

1350

✦ Think big with us.

We are a team of passionate digital experts, dedicated to helping businesses grow through cutting-edge web design, strategic digital marketing, and creative branding solutions.

Our mission is to transform your ideas into a powerful online presence that drives results.

Our Services

Work hand-in-hand with ex-founders, design leaders and a world-class design team to create unconventional brands and digital products of the future.

Web Design & Development

Crafting responsive, visually stunning websites that engage your audience and drive conversions.

Branding & Identity

Building memorable brand identities that resonate with your target audience.

SEO & Digital Marketing

Boost your online visibility with strategic SEO and data-driven digital marketing campaigns. (Hover)

Social Media Management

Growing your online community with engaging social media content and campaigns.

Content Creation

Creating compelling content that tells your brand’s story and attracts the right audience.

Custom Solutions

Tailored digital solutions that meet your unique business challenges.

Our Recent Work

Check out some of our latest projects, from cutting-edge websites to successful digital campaigns.

What Our Clients Say

Donald Simpson

Consulting theme is an invaluable partner. Our teams have collaborated to support the growing field of practitioners using collective impact.

Amanda Seyfried

We were amazed by how little effort was required on our part to have Consulting WP prepare these materials. We exchanged a few phone calls.

Debbie Kübel-Sorger

The demands for financial institutions have changed a bit. Obfuscation is no longer accepted, which is why this Business WordPress Theme is so perfect.

Cintia Le Corre

We thought a lot before choosing the Financial WordPress Theme because we wanted to sure our investment would yield results.

Christian Marcil

Consulting WordPress Theme is the way to go for financial institutions. We take pride in being a transparent and perfection oriented organization.

Bianca Hammound

Prior to joining Consulting WP, Bianca ran a project management software firm in the U.S. and worked in consulting and investment banking.

Adam Buschemi

Since joining Consulting WP in 1998, Alice has developed extensive experience in large-scale transformation and strategy work, often in connection with mergers.

Bernard Lesser

With just a few tweaks our website looked almost nothing like the template; it looked completely like something we had made from scratch for our company.

Got a big idea? Let’s get to work.

Move your business forward with the power of design,

technology and innovation.

Meet Our Team

Exploring the Talented Members of Our Creative Crew.

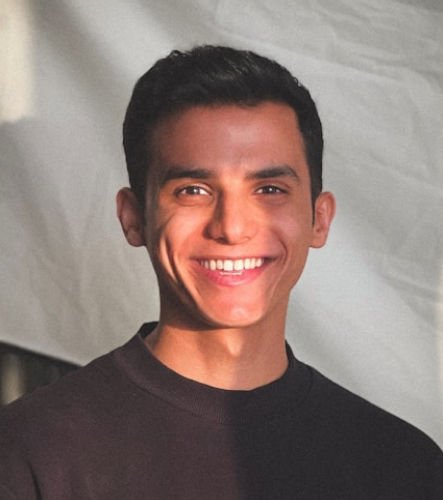

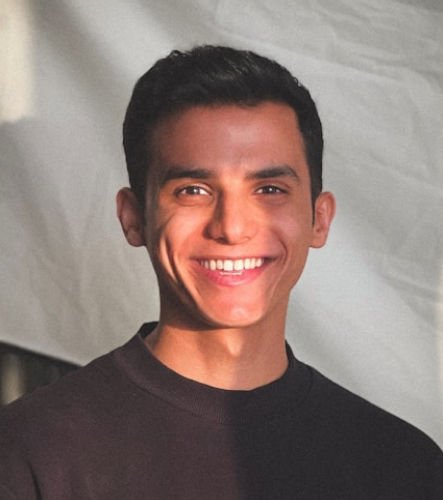

Brandon Copperfield

Clark Roberts

Ashley Hardy

Dennis Norris

Gina Kennedy

Fernando Torres

Kim Su Hao

Why Choose Our Company

Our mission is to transform your ideas into a powerful online presence that drives results.

Exceptional Team

Creative, skilled professionals ready to deliver top results.

Fast & Reliable Service

We deliver high-quality results quickly and efficiently.

24/7 Support

Always available to assist you whenever needed.

Competitive Pricing

Affordable solutions without compromising quality.

Blog

Stay informed with the latest updates and insights from the digital world

Contacts

5010 Avenue of the Moon, New York, NY 10018 US.

info@stylemixthemes.com

212-714-0177

Get in touch